The United States government provides unique tax benefits for people who save for retirement via a Roth IRA or Individual Retirement Account. what is a roth ira vs 401k, money is put in after taxes have already been taken out, so there is no immediate tax benefit. Withdrawals from a Roth IRA, however, are entirely tax-free. Contributions and investment gains are considered qualified distributions and are not subject to taxation.

Roth IRA guidelines include yearly contribution limits of $6,000 (or $7,000 for individuals aged 50 or over) and income limits determining eligibility for contributions. Roth IRAs give you more control over your retirement assets since, unlike standard IRAs, you don't have to take RMDs (required minimum distributions) during your lifetime. Benefits of a Roth IRA investment include freedom from required minimum distributions (RMDs), tax-free withdrawals, and estate planning opportunities.

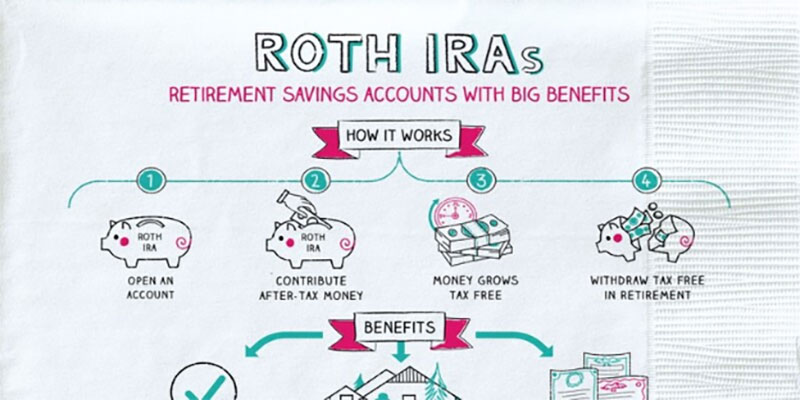

What is a Roth IRA?

You can open a retirement account called a Roth IRA in the United States. In honor of his role in the bill's development, Senator William Roth gave it his name. what is a backdoor roth ira Unlike traditional IRAs, contributions to a Roth IRA are not tax deductible in the year they are made. Contributions and investment earnings, however, are not subject to taxation. The main benefit of a Roth IRA is that withdrawals are made tax-free.

Under certain circumstances, retirees can withdraw tax-free contributions and investment gains through qualified tax-free distributions. With a Roth IRA, investors have more freedom to manage their retirement funds because they are not obligated to take RMDs (required minimum distributions) during their lifetime. The IRS imposes yearly contribution caps and income restrictions on Roth IRA contributions.

Contribution Rules for Roth IRA

The guidelines for funding your Roth IRA are detailed below.

Income Limits

Separate Filers: The following are the income thresholds for single taxpayers in the year 2023:

- Your ability to contribute decreases if your MAGI is between $125,000 and $140,000.

- If your modified adjusted gross income exceeds $140,000, what is a roth ira? you cannot contribute to a Roth IRA as a single filer.

Filing Jointly as Married Couples

The following are the maximum yearly incomes that a married couple filing jointly is allowed to have in 2023:

- If your MAGI is between $198,000 and $208,000, your contribution starts to phase down.

- It's only possible to make a Roth IRA contribution as a couple if your MAGI is less than $208,000.

Contribution Limits

- In 2023, the furthest sum you can put into a Roth IRA each year is $6,000.

- Those 50 or older can make a $1,000 catch-up payment, raising their total annual contribution limit to $7,000.

- The annual limit on contributions to all Roth IRAs owned by the same person is $100,000. The yearly contribution limit applies even if you have more than one Roth IRA.

Requirements for Eligibility

- Contributing to a Roth IRA requires you to have earned income. Wages, salaries, tips, and profits from side hustles are all examples of this type of revenue. Earnings from investments and rents do not qualify as earned income for Roth IRA contributions.

- Unlike standard IRAs, there is no upper age limit for contributing to a Roth IRA. Anyone with a steady source of money is welcome to contribute.

- You can contribute to your Roth IRA for the tax year until the deadline for filing your taxes that year (usually April 15). For the 2023 tax year, you have until April 15, 2024, to donate.

Benefits of a Roth IRA

The advantages of a Roth IRA are manifold.

- Withdrawals from a Roth IRA are not subject to taxes if they meet specific criteria. Your contributions and any interest you earn on them are included. You can get money without paying taxes on it once you're retired.

- Unlike traditional IRAs, Roth IRAs do not need annual distributions from the account holder. You can delay withdrawing from your investment account, giving your money more time to grow.

- Because you have already paid taxes on your Roth IRA contributions, you can withdraw them whenever you like. Earnings can be withdrawn tax-free after reaching ages 59 and 12 and maintaining an account for at least five years.

- Roth IRAs benefit estate planning since beneficiaries can inherit the account and continue receiving tax-free withdrawals. That's why they're a great asset for tax-efficient wealth transfer and estate planning.

Conclusion

Individuals in the United States can take advantage of tax breaks when they open a Roth IRA. After-tax dollars are used to fund a Roth IRA, and any subsequent tax-free withdrawals of the account's principal as well as any investment gains, are enjoyed in full. There are yearly contribution caps and income caps for a Roth IRA. There are no mandatory withdrawals from a Roth IRA during the account holder's lifetime, giving them more control over their retirement funds.

Roth IRAs are advantageous because they allow for tax-free withdrawals, many withdrawal alternatives, no required minimum distributions, and can be used in estate planning. It enables people to receive tax-free retirement income and pass on assets to their heirs to minimize taxes. One must select a financial institution, open an account, make qualified contributions, and then choose investments to participate in a Roth IRA.

Understanding and Filing Form 1065: U.S. Return of Partnership Income

What Do You Need To Know About P/E Mean?

Why Your Home Is Not Selling: Find All The Reasons

What Is the Purpose of a Cross-Currency Trade?

6 Investment Platforms to Consider Besides Personal Capital

Group Life Insurance Explained: Assessing Its Suitability for You

CapEx vs. OpEx: Unveiling the Financial Variances

Net Profit Margin: What Is It, Formula, Example, And More

What Is a Roth IRA? Rules, Benefits, and Investing Methods

Exploring The Most Heavily Shorted Stocks In The Market: A Comprehensive Analysis

What is Active Income and How Does It Differ from Passive Income?