When managing your finances, numerous tools and platforms help you track your spending, budget your income, and invest wisely. Personal Capital is a popular financial management tool that offers a range of features for users to monitor their finances and plan for the future.

However, several other options exist if you're looking for the best alternatives to Personal Capital. Here are some different options for Personal Capital that you may find helpful in managing your finances:

Mint

Mint is a popular personal finance management tool known for its user-friendly interface and robust functionality. The platform offers a wide range of features that make it easy for users to track their finances and stay on top of their financial goals.

Key features

Budget tracking: Users can set up budgets for different categories, such as groceries, entertainment, and transportation, and Mint will track their spending in each category. This makes it easy to see where money is being spent and where adjustments can be made to stick to a budget.

Bill reminders: Users can link their accounts and set up reminders for upcoming bills, ensuring they never miss a payment and incur late fees. It helps users stay organized and on top of their financial obligations.

Credit score monitoring: Users can see their credit score and receive alerts if there are any changes. It can help users understand their financial health and take steps to improve their credit score if needed.

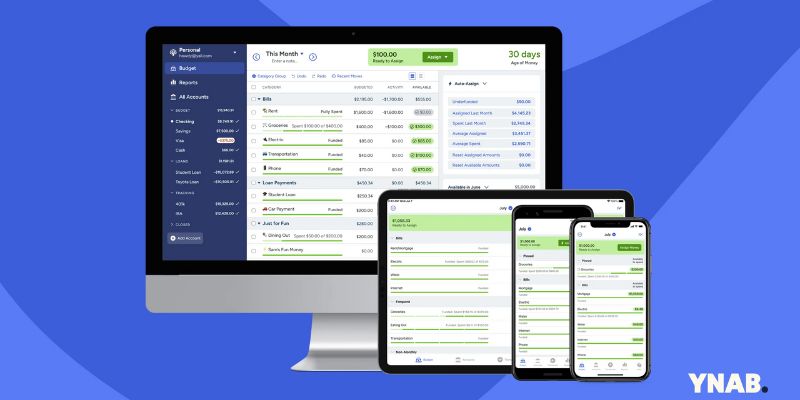

YNAB (You Need a Budget)

Is there an app better than Personal Capital? Yes, YNAB is a popular budgeting app that focuses on helping users allocate funds effectively. While Personal Capital is more geared toward overall financial management and investment tracking, YNAB is specifically designed to help users improve their budgeting skills and take control of their finances.

Key features

Goal-setting capabilities: Users can set specific financial goals, such as saving for a vacation or paying off debt, and track their progress over time. This helps users stay motivated and focused on their financial objectives.

Zero-based budgeting approach: It means every dollar you earn is assigned a specific job, whether it's for bills, savings, or spending. This method encourages users to be intentional with their money and ensures that every dollar has a purpose.

Quicken

Quicken is a comprehensive financial management software that offers a wide range of features to help users manage their finances effectively.

Key features

Investment tracking: It allows users to keep track of their investments, monitor their performance, and make informed decisions about buying or selling stocks, bonds, or other securities. This feature is handy for individuals who are actively involved in managing their investment portfolios.

Tax planning tools: With Quicken, users can easily track their income, expenses, and deductions throughout the year, making it easier to prepare for tax season. The software also provides users with tax planning tips and strategies to help minimize their tax liability and maximize their savings.

Debt reduction tools: Quicken also offers debt reduction tools to help users manage and pay off their debts. Users can set up a debt repayment plan, track their progress, and see how different payment strategies impact their financial health. This feature is handy for individuals looking to get out of debt and improve their financial situation.

Tiller Money

Tiller Money is a unique personal finance tool that utilizes spreadsheets to help users manage their finances effectively.

Key features

Integration with Google Sheets lets users easily track their income, expenses, and budget in a familiar and customizable format. It makes it easy for users to personalize their financial tracking based on their needs and preferences.

Automatic update: It can automatically update financial transactions from bank and credit card accounts, saving users time and effort manually inputting data. This real-time tracking helps users stay on top of their finances and make informed decisions about their spending habits.

Templates and tools: Tiller Money offers a variety of templates and tools to help users analyze their financial data, set financial goals, and create customized reports. It can be especially beneficial to want a more detailed understanding of their financial situation and want to improve their financial health.

EveryDollar

EveryDollar is a popular personal finance management tool known for its user-friendly interface and efficient functionality. The platform is designed to help users create and stick to a budget, track expenses, and set financial goals.

Key features

Simple and intuitive layout: This makes it easy for users to input their income and expenses, categorize transactions, and monitor their spending.

Functionality: EveryDollar offers a range of tools to help users manage their finances effectively. Users can create custom budget categories, set spending limits, and receive real-time updates on their financial progress. The platform also allows users to link their bank accounts for automatic transaction syncing, making staying up-to-date on their finances easy.

Benefits

One of the main benefits of EveryDollar is its ability to provide users with a clear overview of their financial situation. By tracking expenses and setting budget goals, users can better understand where their money is going and make informed decisions about their spending habits.

Additionally, EveryDollar offers personalized tips and recommendations to help users improve their financial health and achieve their goals.

PocketGuard

PocketGuard is a popular personal finance management tool with a user-friendly interface and impressive functionality. The app is designed to help users efficiently track their income, expenses, and savings in one convenient place. The clean and intuitive interface makes it simple for users to input their financial information and view their overall financial health at a glance.

Key features

Automatically categorize transactions: Its ability to categorize transactions automatically makes it easy for users to see where their money is going. The app also provides personalized insights and recommendations to help users make better financial decisions.

Budgeting tools allow users to set spending limits for different categories and track their progress over time.

Takeaway

Each alternative to Personal Capital offers unique features and benefits to help you manage your finances effectively. Whether looking for a comprehensive financial management tool like Quicken or a simple budgeting app like Mint, exploring these alternatives can help you find the right tool to meet your financial goals.

TurboTax vs H and R Block: Which Is the Better Choice for Your Taxes

A Quick Overview: What Is the Risk/Reward Ratio

Why Your Home Is Not Selling: Find All The Reasons

Dealing With A Surging Housing Market

Options Basics: How To Pick The Right Strike Price In 2022

A Comprehensive Guide to Accessing Your IRS Account

6 Investment Platforms to Consider Besides Personal Capital

What Do You Need To Know About P/E Mean?

CapEx vs. OpEx: Unveiling the Financial Variances

BMO Mortgage Review 2024

8 Best Ways to Invest $10K in 2024